The cost of rent in the Greater Toronto Area experienced a sizeable decline at the end of 2023, but the falling prices did not equate to an improvement in affordability.

According to new data from Urbanation, the average rent for a condo in the GTA fell 5.7% on a quarterly basis in Q4 2023 to $3.97 per square foot, or $2,821 per month for a 710 sq. ft. unit.

Outside of the pandemic-fuelled dip seen in Q4 2020, the decline marked the largest quarterly rent reduction since Urbanation began tracking in 2010. On an annual basis, average condo rents rose 4.5% in Q4, a far slower pace of growth than the 16.2% year over year increase recorded in Q4 2022.

Rather than an actual improvement in affordability, though, it was likely a response to the surging rents seen in the preceding two quarters, which brought the average rent for a condo in the GTA to a record high of $4.21 psf. in Q3, or $2,937 for a 697 sq. ft unit.

In fact, there was a "dramatic decline" in affordable rentals throughout 2023. The number of condos listed below $2,250 per month dropped 75% annually last year, bringing the leasing market share from 25% to 6%. The least expensive condos — those listed below $2,000 — experienced a 91% year-over-year decline in leasing activity, representing less than 1% of rental activity in 2023.

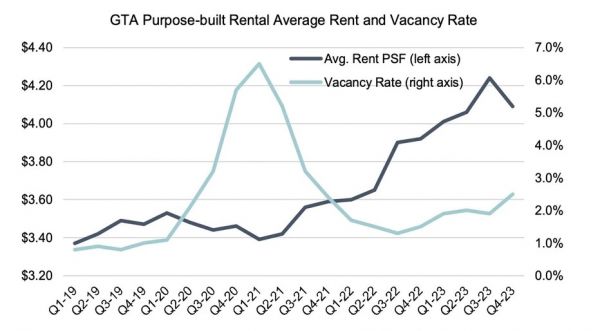

The purpose-built rental market experienced a "similar softening," with average rents for units constructed since 2003 dropping 3.5% quarter over quarter to $4.09 psf. in Q4 2023, or $2,972 for 727 sq. ft. Annually, rents were up 4.3%, the slowest growth rate in two years.

While a persistent lack of affordability doesn't give tenants the upper hand, the rental market regained a sense of balance at year-end as a wave of new supply flooded in.

The number of newly completed and registered condos increased 26% annually in Q4 to 7,408 units, leading to a 10% year-over-year increase in units listed for rent. Lease transactions rose by just 4%, pushing active rental listings up 37% annually in Q4.

As such, the ratio of condo leases to listings fell to 71%, an 11-quarter low, while the average time on market edged back up to its 10-year average of 18 days. While still low, the 0.9 months of supply at the end if 2023 was the highest level since early 2021.

The supply of purpose-built rentals also flourished in the final months of the year, with quarterly completions hitting a 30-year high of 1,863 units, bringing the vacancy rate to a nine-quarter high of 2.5% in Q4.

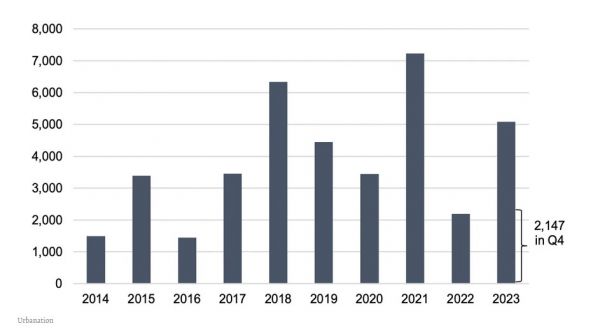

And more appears posed to come: after the federal and provincial governments announced plans to cut HST from new purpose-built rentals, starts accelerated to a 10-quarter high of 2,147 units in Q4.

This brought total rental construction starts in the GTA to 5,085 units in 2023, a 132% increase over 2022’s 2,189 units, and the third-highest level over the past 10 years. While this is a "positive sign," Shaun Hildebrand, President of Urbanation, noted that more progress must be made before long-term supply benefits are to be realized. Compared to Q4 2021, the total number of rental units under construction declined 4% to 18,255 units.“The recent moderation in the rental market is likely a temporary response to overheated conditions that emerged in the past two years,” Hildebrand said. “The fundamentals still indicate an undersupplied market will remain."

TORONTO STOREYS

PUBLISHED: January 23, 2024

Written by: Zoe Demarco

Photo by Adrien Olichon from Burst